georgia ad valorem tax rv

The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. Vehicles purchased on or after March 1 2013.

Peaknocker Rd Lot 42 Sparta Ga 31087 Realtor Com

The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system.

. Instead these vehicles will be subject to a new one-time title ad valorem tax that is based on the value of the vehicle. Problem is theres a 7 ad valorem tax that will be assessed on our RV when we register it based on fair. The family member who is titling the vehicle is.

Contact your County Tag County Office to see. Georgia Report post Posted January 14 2016 When registering a RV in Georgia be prepared to pay the total ad valorem tax up front. Beginning March 1 2013 the Georgia tax rules applicable to motor vehicles changed significantly.

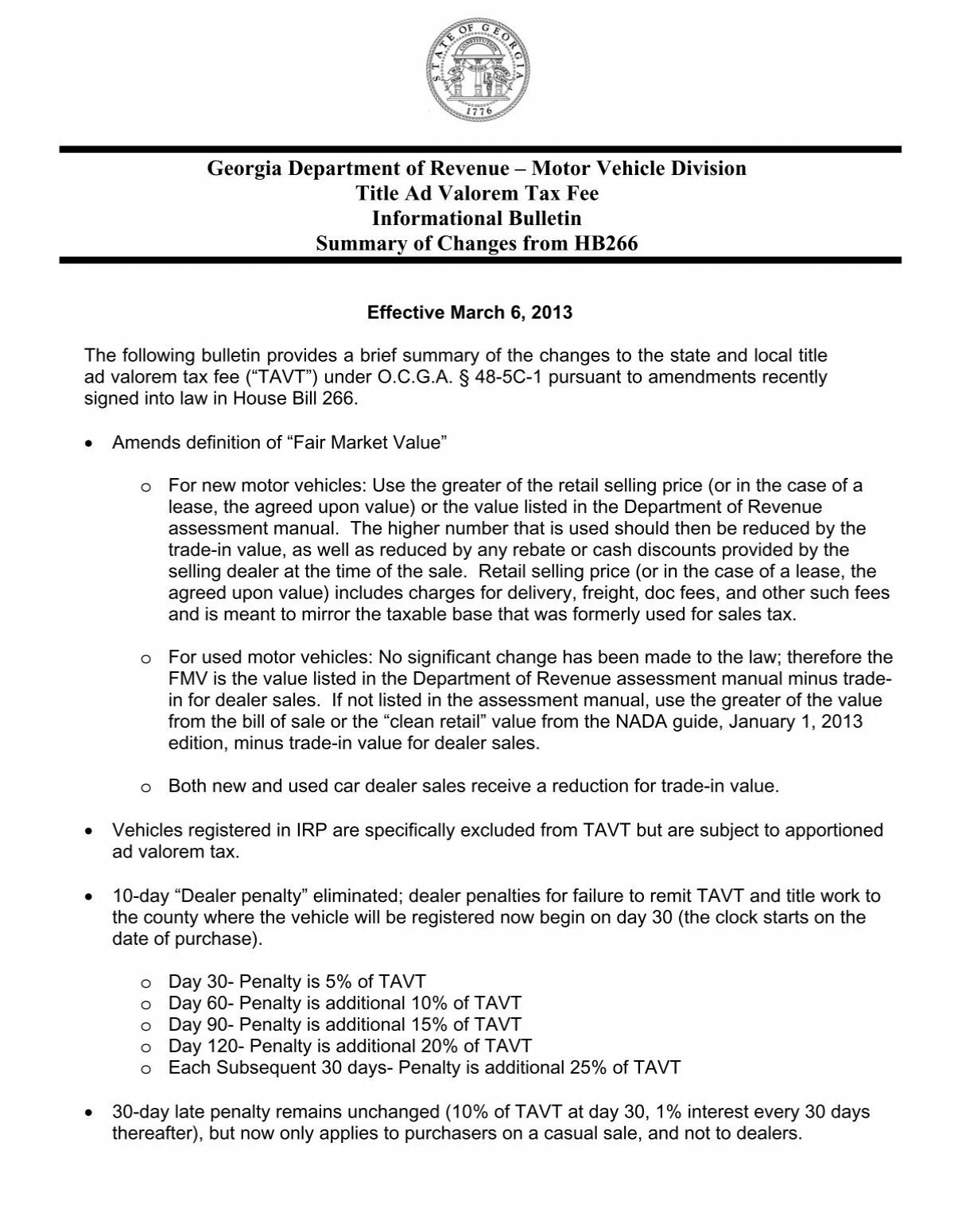

Get started Youll need your VIN vehicle. Vehicle Taxes - Title Ad Valorem Tax TAVT Title Ad Valorem Tax TAVT became effective March 1 2013 after the Georgia General Assembly passed HB386 in the 2012. Generally any motor vehicle purchased on or after March 1 2013 and.

Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. The family member who is titling the vehicle is. Take your completed forms and payment for the 12 license plate fee plus any payment for any required ad valorem tax to the GA Tax Commissioners tag office in your county.

Vehicles purchased on or after March 1 2013. The basis for ad valorem taxation is the fair market value of the. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

We have since relocated up to Georgia and brought the RV with us. Georgia is exempt from sales and use tax and the annual ad valorem tax also known as. In addition if you purchase and title a vehicle between.

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia. Georgia ad valorem tax rv Wednesday April 27 2022 You only pay this tax one time. Ad valorem tax more commonly known as property tax is a large source of revenue for governments in Georgia.

The Ad Valorem Tax or the Property Tax is based on value. The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit. Ad valorem tax is based on the vehicles value and the financial needs of various levying authorities in your county of residence.

Having done this we just went get our 2000. RV sales tax ad valorem is actually 7.

Georgia Taxes Page 2 Irv2 Forums

Tax And Incentives Okefenokee Chamber Of Commerce And Visitor Center

Pdf Making The Property Tax Work International Center For Public Policy Working Paper 13 11

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

Motor Vehicle Registration Pickens County Georgia Government

Car Tax By State Usa Manual Car Sales Tax Calculator

Rv Registration Rules By State Rvblogger

/cloudfront-us-east-1.images.arcpublishing.com/gray/GM6M3QBWAJFG5NA7UGN5YWIT4I.jpg)

City Of Tybee Holding Public Hearing On Possible Property Tax Increase

Georgia Title Ad Valorem Tax Updated Youtube

![]()

Georgia New Car Sales Tax Calculator

Cherokee County Ga Motor Vehicles

Georgia State Veteran Benefits Military Com

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Big Sky Problems In Using A Montana Llc To Avoid Georgia S 7 Tax On Car Purchases Litwin Law

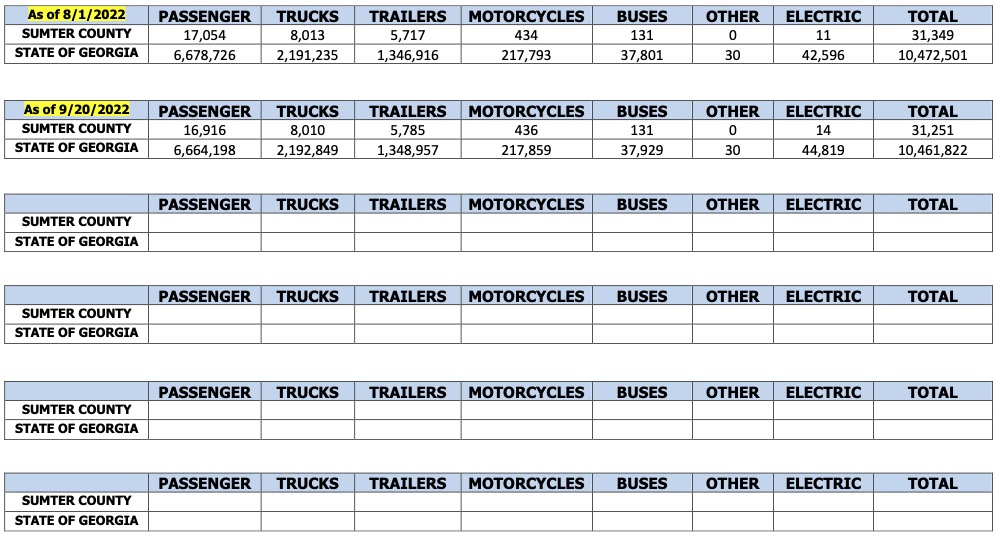

Sumter County Georgia Motor Vehicles

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia